Systematic Transfer Plan 5 Guaranteed Benefits

Systematic Transfer Plan (STP): A Smart Way to Invest in Mutual Funds

Summary: This guide explains what a Systematic Transfer Plan is, how it works, key benefits, types, a step-by-step example, and who should consider using it.

What is a Systematic Transfer Plan (STP)?

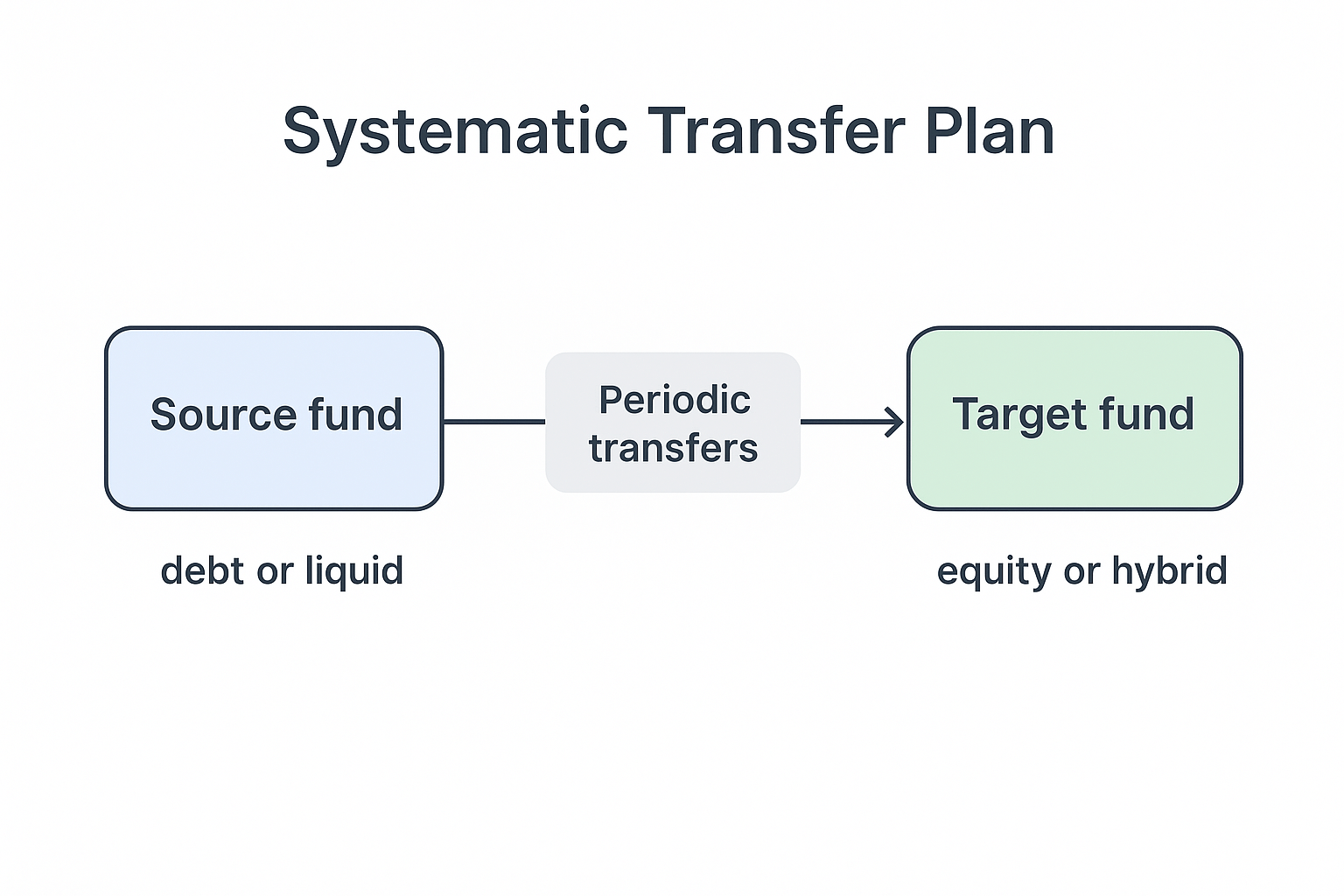

A Systematic Transfer Plan (STP) is a mutual fund facility that moves a fixed amount at regular intervals from one scheme (commonly a liquid or debt fund) to another scheme (typically an equity or hybrid fund). By spreading entries over time, STP lowers the risk of investing a lump sum at a potentially unfavorable market level.

Think of it as an internal, rule-based bridge between two funds. You place the lumpsum in the source fund, then the plan automatically transfers money to the target fund at the frequency you choose.

How a Systematic Transfer Plan Works

- Invest a lump sum in a liquid/debt fund (source).

- Select your target scheme (equity or hybrid).

- Choose frequency (monthly/weekly) and transfer amount.

- The fund house executes transfers on schedule, buying units of the target fund over time.

Benefits of Using a Systematic Transfer Plan

1) Rupee-Cost Averaging

Regular transfers accumulate units at different prices, smoothing the impact of volatility.

2) Better Use of Idle Cash

Until transfer, your capital can earn from the source fund (often a liquid or ultra-short duration fund), rather than sitting in a low-yield account.

3) Disciplined, Automated Approach

Rules reduce emotion-driven decisions and encourage consistent investing toward goals.

4) Risk Management

Gradual movement into equity can reduce timing risk compared to a single large entry.

Types of Systematic Transfer Plan

- Fixed STP: A constant amount is transferred each interval.

- Capital Appreciation STP: Transfers only the gains from the source fund.

- Flexible STP: Transfer amount varies based on a predefined rule (e.g., market levels).

Who Should Use It?

- Investors with a lump sum who prefer phased equity exposure.

- Conservative investors seeking a balanced path between debt and equity.

- Goal-based planners (education, retirement, wealth creation) who want volatility control.

Illustrative Example

Assume you have ₹12,00,000. Instead of investing it all in an equity scheme today, you park the amount in a liquid fund and set a 12-month STP of ₹1,00,000 per month to your chosen equity fund. If markets fluctuate, your purchase prices get averaged; meanwhile, the liquid fund can generate modest returns on the yet-to-be-transferred balance.

Practical Tips & Considerations

- Match horizon to goal: Ensure your transfer period and target fund align with the timeline of your financial objective.

- Mind exit loads & taxes: Check exit loads on the source fund and taxation on both source and target funds.

- Review but don’t react: Assess performance quarterly; avoid changing the STP mid-way due to short-term noise.

- Choose quality funds: Prefer well-rated liquid/debt funds and diversified equity funds from reputed AMCs.

For investor education and regulations, refer to the official SEBI Investor Education portal.

Conclusion & Next Steps

A Systematic Transfer Plan offers a structured way to move from debt to equity, adding discipline, rupee-cost averaging, and better cash utilization. It’s not a guarantee against losses, but it can meaningfully reduce timing risk and build confidence as you progress toward long-term goals.